flow through entity irs

Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing. The entitys income only goes through a.

4 Types Of Business Structures And Their Tax Implications Netsuite

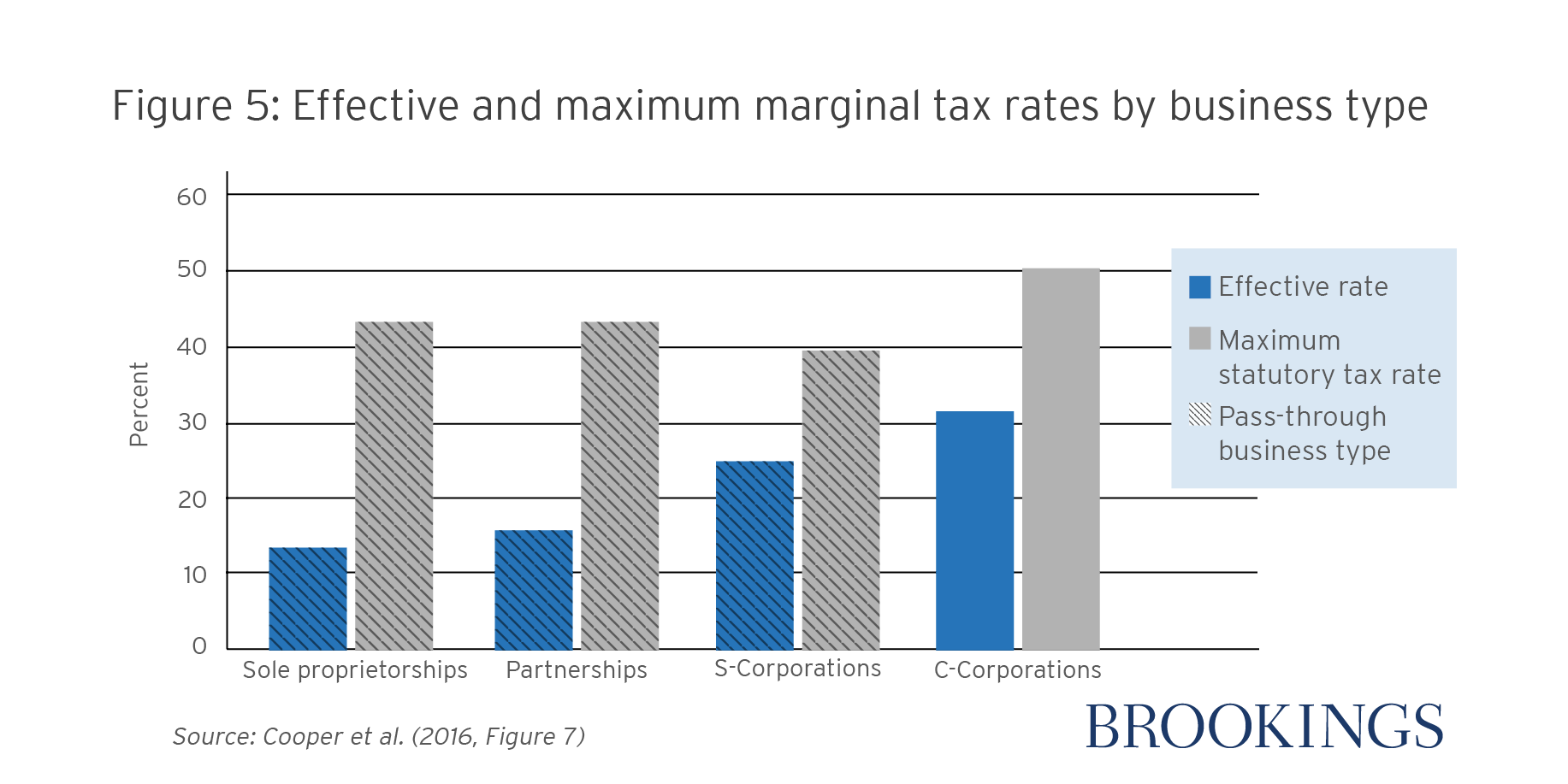

A flow-through entity FTE is a legal entity where income flows through to investors or owners.

. A trust maintained primarily for the benefit of. Its gains and losses are allocated. Flow-through entities FTEs affect an individuals Foreign Tax.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Flow-Through Entity Tax - Ask A Question. Per the MI website this tax allow s certain flow-through entities to elect to file a return.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A business owned and operated by a single individual. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

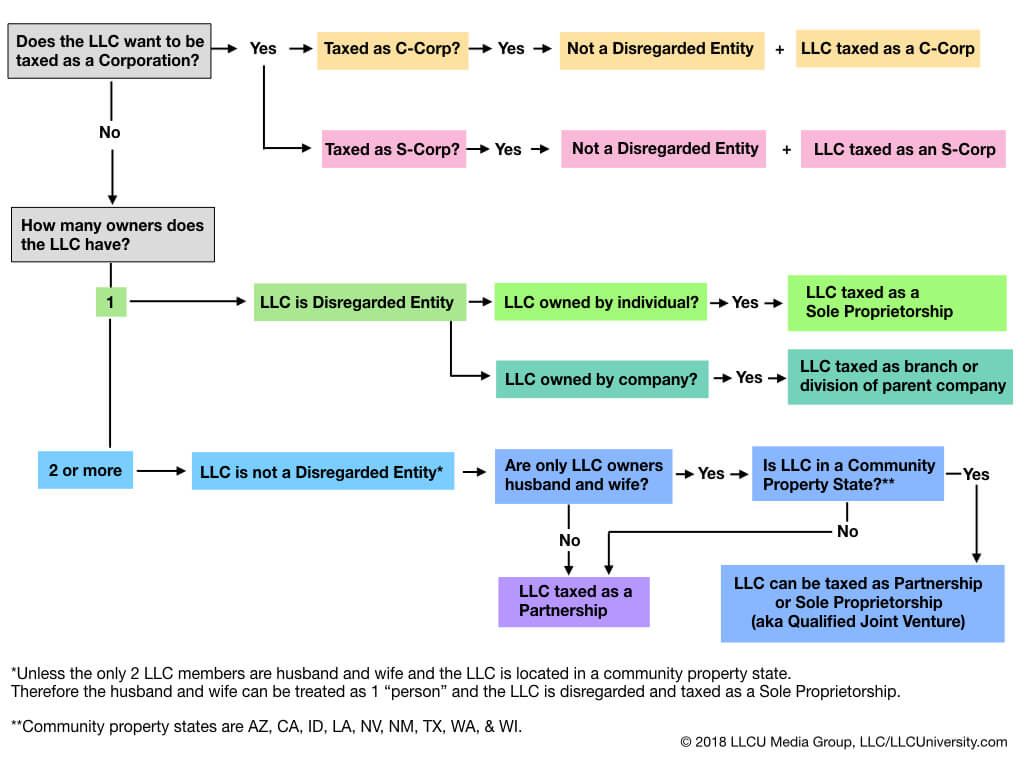

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. A flow-through entity is an entity through which income flows to the owners or investors without being subject to taxation at the entity level. There are two major reasons why owners choose a flow-through entity.

In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the updates. This disconnect between receipt of cash and. This Practice Unit is updated to reflect the recent finalized Treas.

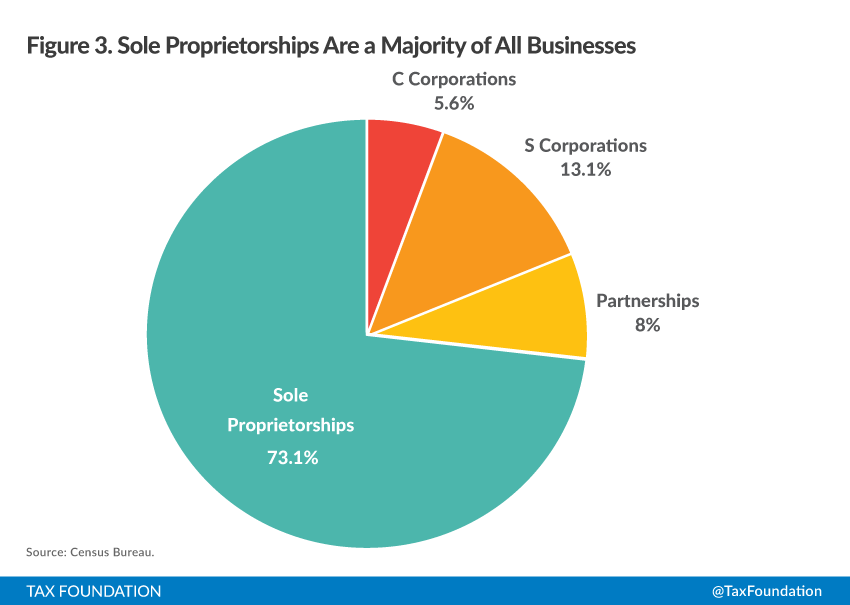

Most small businessesand quite a few larger onesare set up as pass-through entities. There are three main types of flow-through entities. Payments made to a foreign intermediary or foreign flow-through entity are treated as made to the payees on whose behalf the intermediary or entity acts.

A flow-through entity is also called a pass-through entity. Flow-Through Entities Effects on FTC NOTE. All of the following are flow-through entities.

Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. That is the income of the entity is treated as the income of the investors or owners.

A foreign part See more. Income that is or is deemed to be effectively connected with the conduct of a US. The most common type of flow-through entity is.

A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. 2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act. Log on to Michigan Treasury Online MTO to update.

Branches for United States Tax Withholding and Reporting. Trade or business of a flow-through entity is treated as paid to the entity. Advantages of a Flow-Through Entity.

The Michigan flow-through entity tax is enacted for tax years beginning on and after January 1 2021. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. This rule applies for purposes of Chapter 3 withholding and for Form 1099 reporting and backup withholding.

Types of flow-through entities. However the late filing of 2021 FTE returns will be.

An Overview Of Pass Through Businesses In The United States Tax Foundation

9 Facts About Pass Through Businesses

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

What Is A Disregarded Entity Llc Llc University

Converting From C To S Corp May Be Costlier Than You Think

9 Facts About Pass Through Businesses

Oregon Pass Through Entity Elective Tax Kernutt Stokes

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

What Are Pass Through Businesses Tax Policy Center

:max_bytes(150000):strip_icc()/changing-your-llc-tax-status-to-a-corporation-or-s-corp-398989-FINAL-edit-a7c328f6cc494d9d9e60f964181583e4.jpg)

How To Change Your Llc Tax Status To A Corporation Or S Corporation

Pass Through Taxation What Small Business Owners Need To Know

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

New 2022 Irs Changes Funds Partnerships Required Schedule K 2 And K 3 Us Tax Financial Services

An Overview Of Pass Through Businesses In The United States Tax Foundation

9 Facts About Pass Through Businesses

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

Complying With New Schedules K 2 And K 3